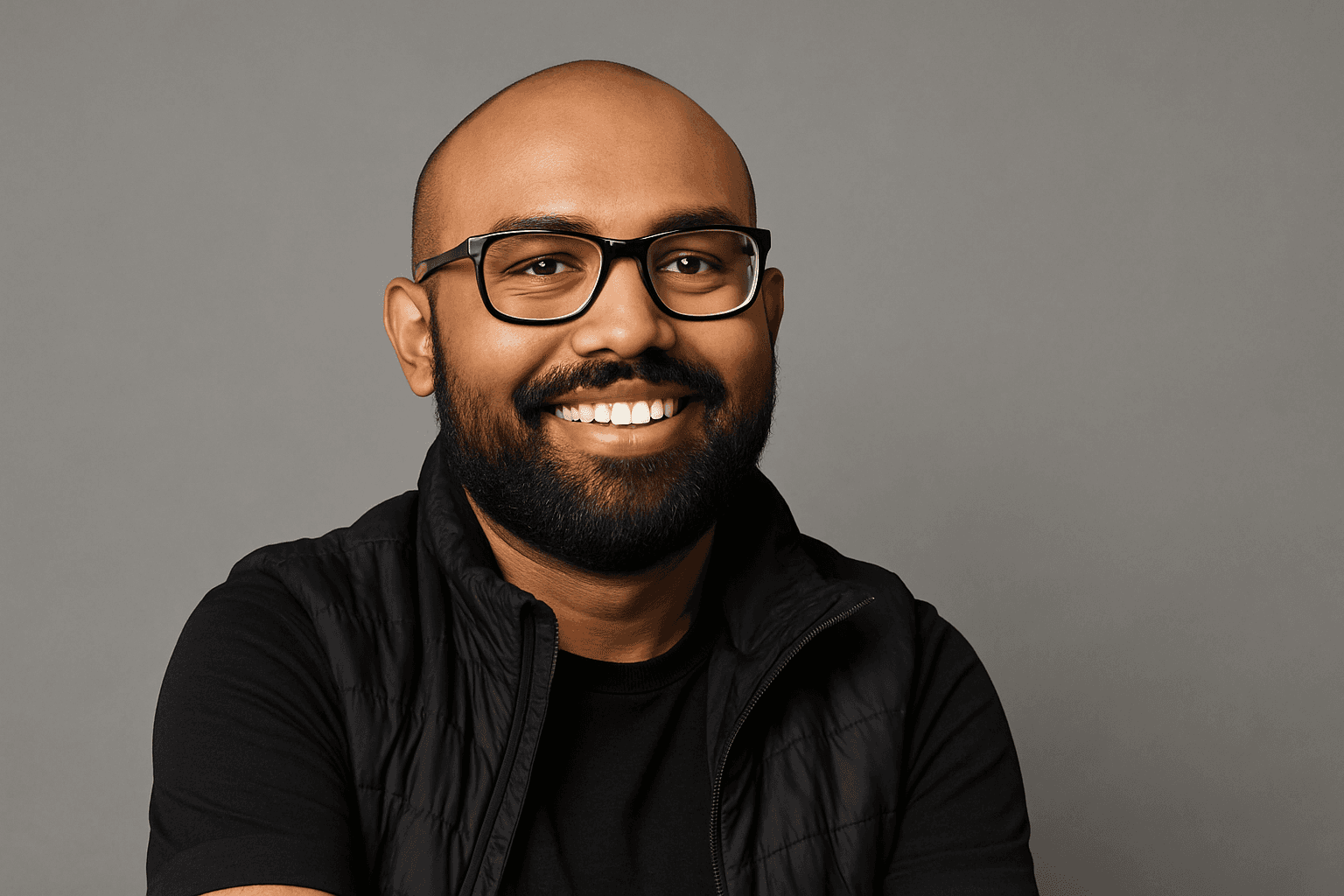

Anthony DenierGroup President & U.S. CEO

Anthony Denier is leading Webull through its first years as a public company, building an AI-enabled global brokerage for sophisticated retail investors while trying to stay nimble, transparent, and close to the everyday trader.

Founder Stats

- Finance, Technology

- Started 2016

- $1M+/mo

- 50+ team

- USA

About Anthony Denier

Anthony Denier was Webull's first U.S. employee and now leads the newly public brokerage under ticker BULL. He built a zero-commission, app-first platform for more experienced retail traders, expanded to 14 markets, and launched Vega, an AI decision partner to cut through noise. Denier is growing hubs in New York and St. Petersburg, linking issuers to shareholders through Corporate Connect, and preaching grind-and-trust leadership so Webull can scale globally without losing speed or transparency.

Interview

November 29, 2025

You were employee number one at Webull. How did you go from starting the U.S. brokerage to leading a public company?

I really was the first Webull employee in the U.S. formed the LLC, hired the first person, and built from 2016/2017 to a public company. Staying close to product and clients and growing with the scale got me from startup founder to public company leader.

Webull operates in a crowded brokerage market. How do you differentiate the platform from other digital brokers?

We target more sophisticated investors. Many customers use Webull as their third brokerage, not first, so we provide deeper data and tools. Launched in 2018 as zero-commission app-first without sacrificing functionality, attracting people who wanted savings plus a full-featured platform.

How have you seen retail investors evolve over the last few years?

Retail once drank from a fire hose of information. They now know what is useful and what is noise, often using multiple platforms. Today they are normalized to data and tools and know which inputs are worth their time. Our job is to help them filter to actionable insights.

You recently launched Vega, Webull’s AI platform. What problem are you trying to solve with it?

Vega looks at what a user follows and invests in, then surfaces relevant information in real time. It narrows the fire hose to a focused stream so clients see actionable insights at the right moment. The industry is moving toward less random data and more personalized context.

How do you decide when to build tools in-house versus partnering with third parties for data and features?

We stay nimble. New data and tech firms appear yearly. Sometimes we build for control; sometimes we partner if a solution is already strong. Being public gives us capital to partner or experiment quickly. The goal is flexibility and speed, not doing everything ourselves.

How has your role changed going from private CEO to public company CEO?

As a private CEO I was deep in daily operations. As a public CEO I step back more, trust the team, and spend more time with investors explaining our moves. That requires strong operators when I am not in the room and leadership focused on trust, communication, and long-term direction.

Be honest, how often do you check Webull’s stock price and how do you think about it?

I do look at the stock price. The key is not to live on quarter-to-quarter moves. I judge on a yearly basis: did we deliver on promises by year-end? Our industry moves in longer cycles, so I focus on products and opportunities that move the needle over time, not daily ticks.

What does your personal information diet look like to stay on top of markets and macro trends?

I keep Bloomberg and CNBC on, read market and flow emails daily, and use train commutes for podcasts, staying centered politically to hear both sides. It is about constant, balanced input rather than one source so I can guide the team and shareholders.

Why did you decide to build a major office in St. Petersburg, Florida in addition to New York?

We bought a St. Petersburg building post-pandemic for operations, customer service, marketing, social, and some institutional work. About 250 people are there. Nearby universities, lower cost of living, and quality of life help recruit talent who do not want a four-hour New York commute, while front-office roles stay in New York.

Webull now operates 14 broker-dealers globally. How do you manage international growth and local teams?

We run 14 broker-dealers, 13 outside the U.S. Each market needs a real local team that defines the product, while we export the U.S. retail experience. Non-U.S. revenue was tiny three years ago; now it is significant and fast-growing, sometimes outpacing U.S. growth.

How different are international users from U.S. users today when it comes to investing behaviour?

Non-U.S. clients are quickly converging with U.S. behaviour. If you are in Kuala Lumpur holding Nvidia, you watch the same news and Reddit threads as New York. Our UK business once thought no one would trade U.S. options; now it is the top revenue product. Mindsets are globalizing.

Who do you think your shareholders are, and how do they discover Webull as an investment?

Shareholders are a mix: some users, some brokerage/fintech believers. Webull is still unknown to many, which is opportunity. Being public lets us tell our story and explain how we differ. Some clients already own the stock a vote of confidence we hope grows.

You offer Corporate Connect for issuers. How is it changing the relationship between public companies and retail investors?

Corporate Connect lets issuers talk directly with their retail shareholders. We approach companies where our clients hold shares and offer a structured, compliant channel. Retail is now a big part of their mix. It helps management tell their story and gives retail a real voice similar to institutions.

Given your Wall Street background and your role today, what is your personal investment philosophy?

My pay is already highly levered to markets, so I avoid doubling down with heavy equity exposure. I stay conservative and like hard assets when possible. I also hold a significant personal stake in Webull, which is my top investment priority.

Looking five years ahead, what non-financial goals or KPIs matter most to you for Webull?

Top non-financial goal is trust from clients and investors. I want true global investing: if we have São Paulo offices, U.S. clients should trade Brazilian stocks as easily as Brazilians trade U.S. stocks; tokenization will help. Innovation is another KPI: being first to new products while larger players turn slowly.

You highlighted fixed income and wealth transfer. Why do you think these areas are so important now?

Fixed income often drives big market events think 2008 or March 2020 so we launched Treasuries and corporate bonds for retail. Large AUM clients are not all in equities; to win wealth transfer you need strong fixed income tools. It is under-discussed but a big opportunity.

Many founders are listening to you. What is your main advice to them about leadership and growth?

Scaling is hard on you and your family. Be clear on what you want to achieve and surround yourself with talented, hard-working people. There is no substitute for grinding every day. I ask employees to be in the office five days a week so we stay collaborative and push through setbacks. Do not be dismayed; keep grinding.

Table Of Questions

Video Interviews with Anthony Denier

Webull ($BULL) CEO Anthony Denier on AI, Going Global, and the Future of Retail Investing | Marketopolis

Cite This Interview

Use this interview in your research, article, or academic work

Related Interviews

Hayes Barnard

Founder & CEO at GoodLeap

Hayes Barnard, founder of GoodLeap, scaled his company into a multibillion-dollar platform by focusing on resilience, ethical choices, and building value in hard markets. Known for his story of overcoming adversity, Hayes inspires entrepreneurs with lessons on leadership, purpose, and perseverance.

Marc Rowan

CEO & Co-Founder at Apollo Global Management

Marc Rowan co-founded Apollo Global Management and grew it into one of the largest alternative investment firms in the world. He believes the future of investing is not only in equities but also in private markets, which now underpin most of the economy. His mission is to open these markets to individuals, create better diversification, and redefine wealth management.

Sadi Khan

Co-founder & CEO at Aven

Sadi Khan, co-founder and CEO of Aven, is building a fintech that allows homeowners to access cheaper credit by combining home equity and credit card models. After leaving Facebook, he set out to attack America’s persistent credit card interest crisis with technology and conviction.