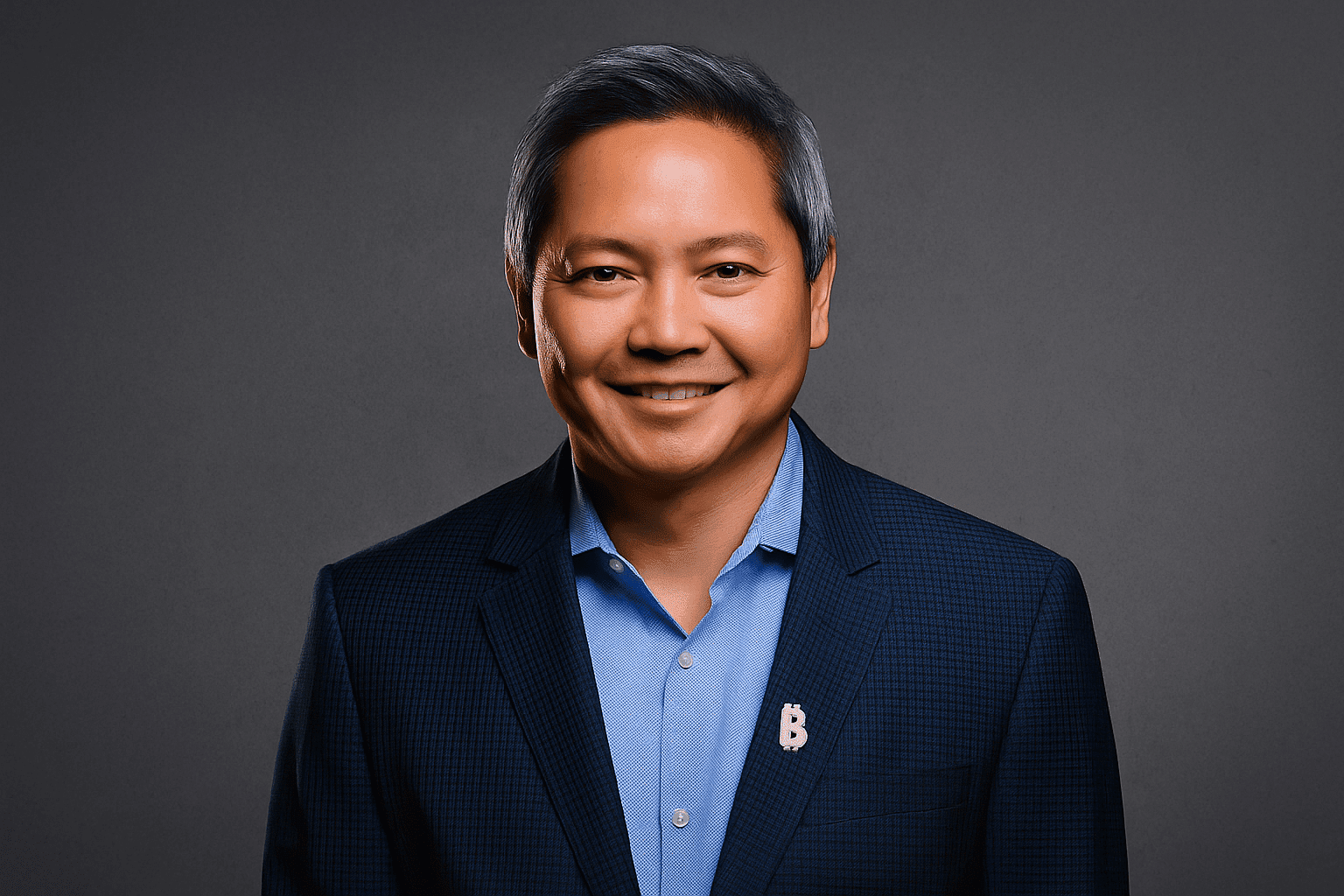

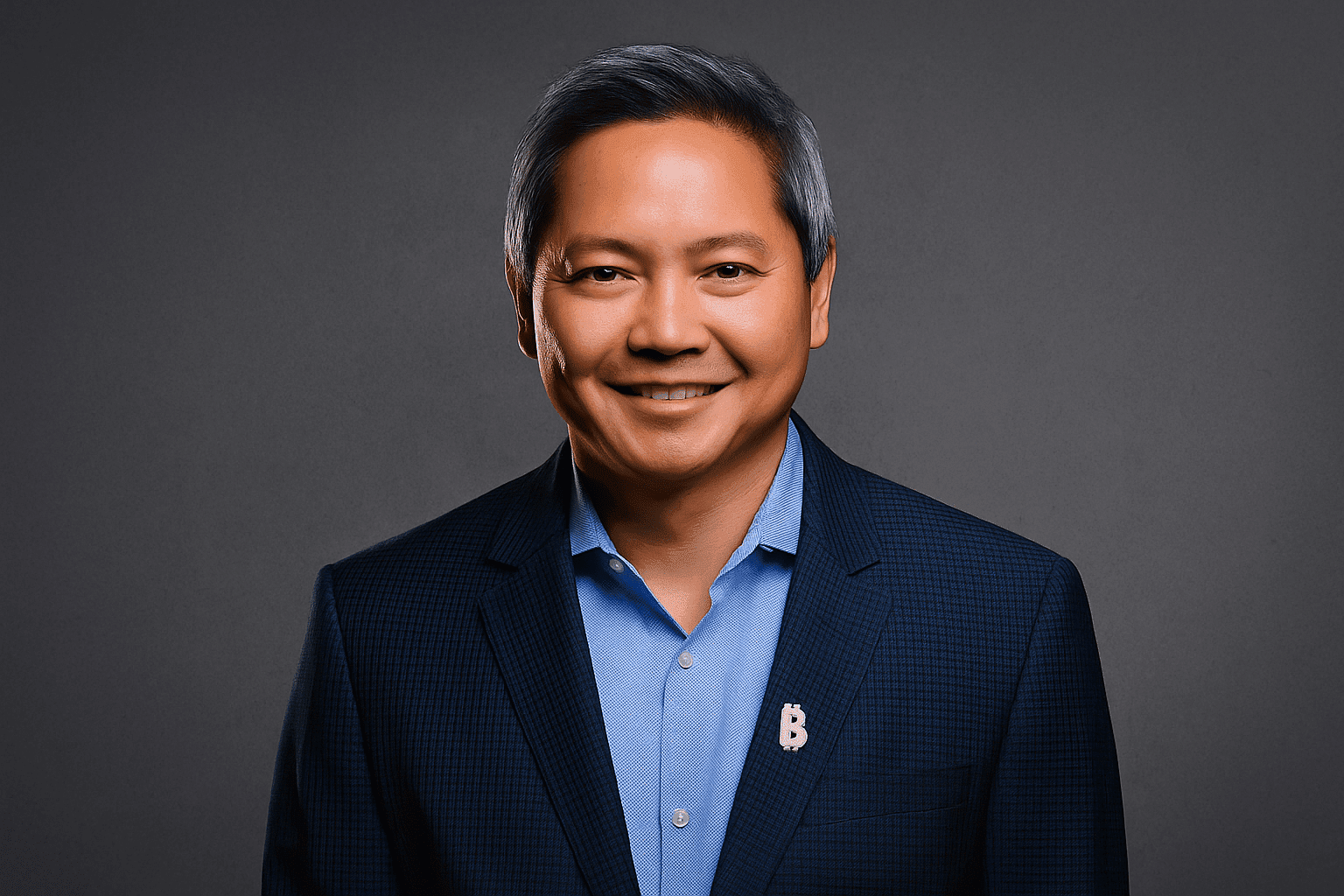

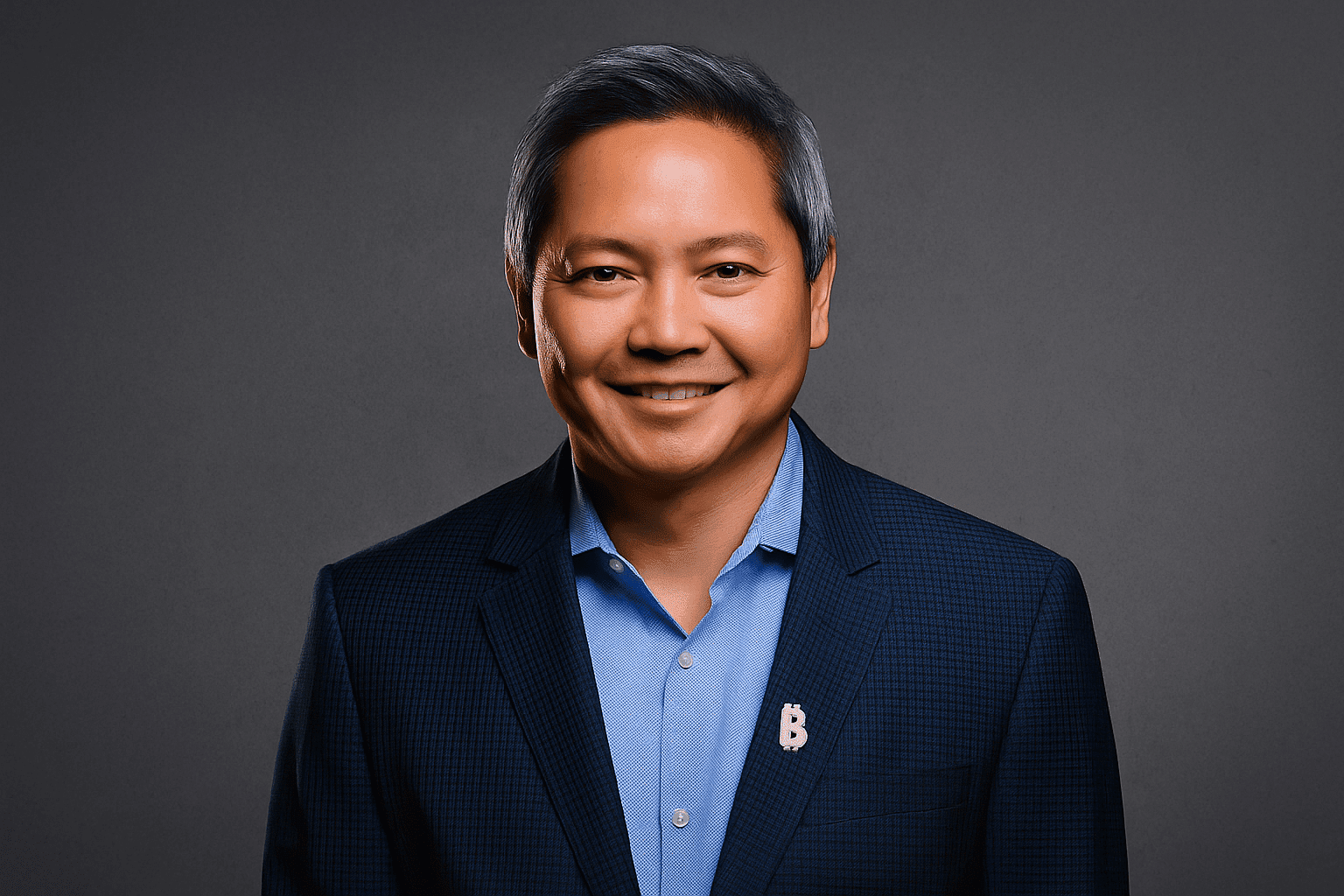

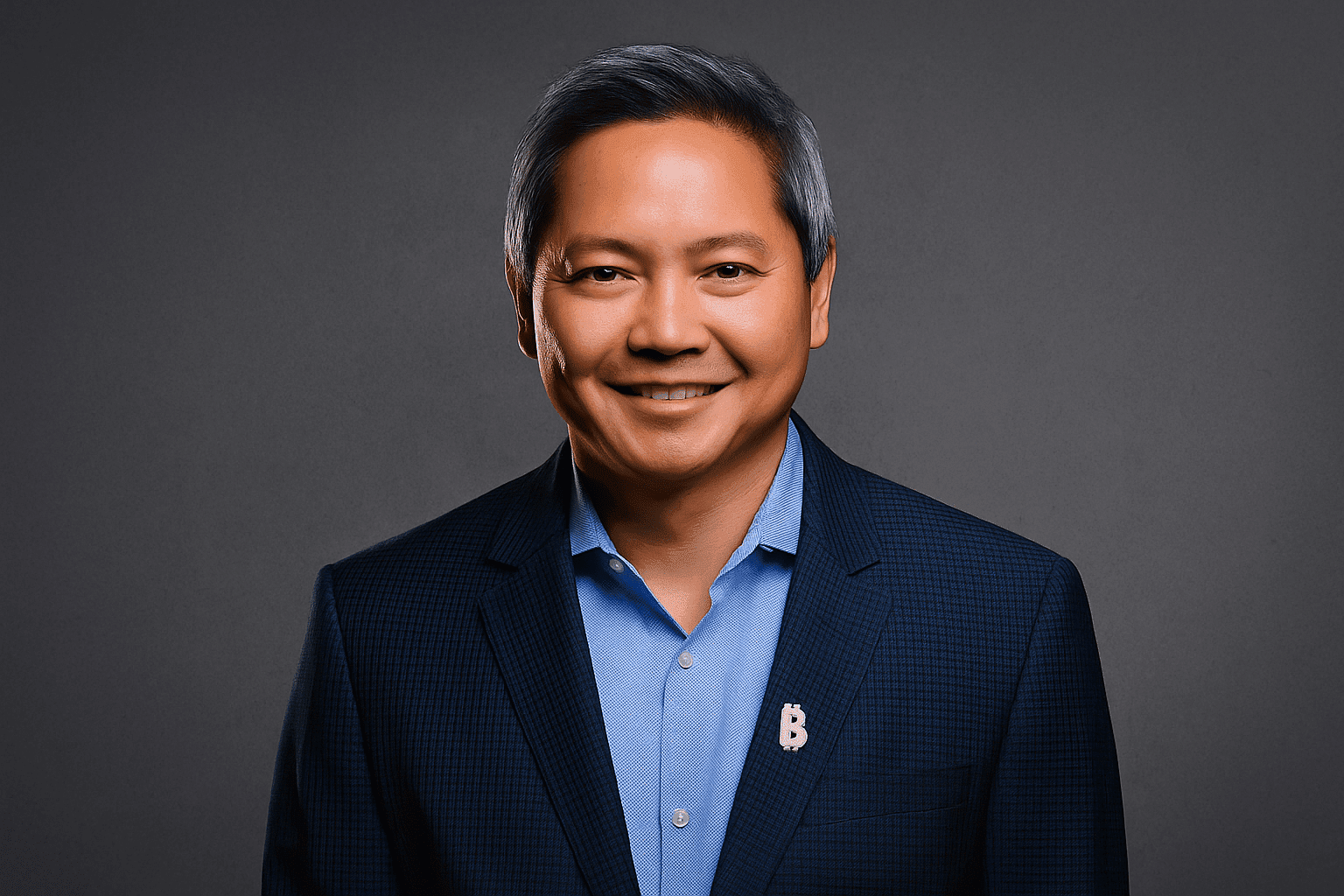

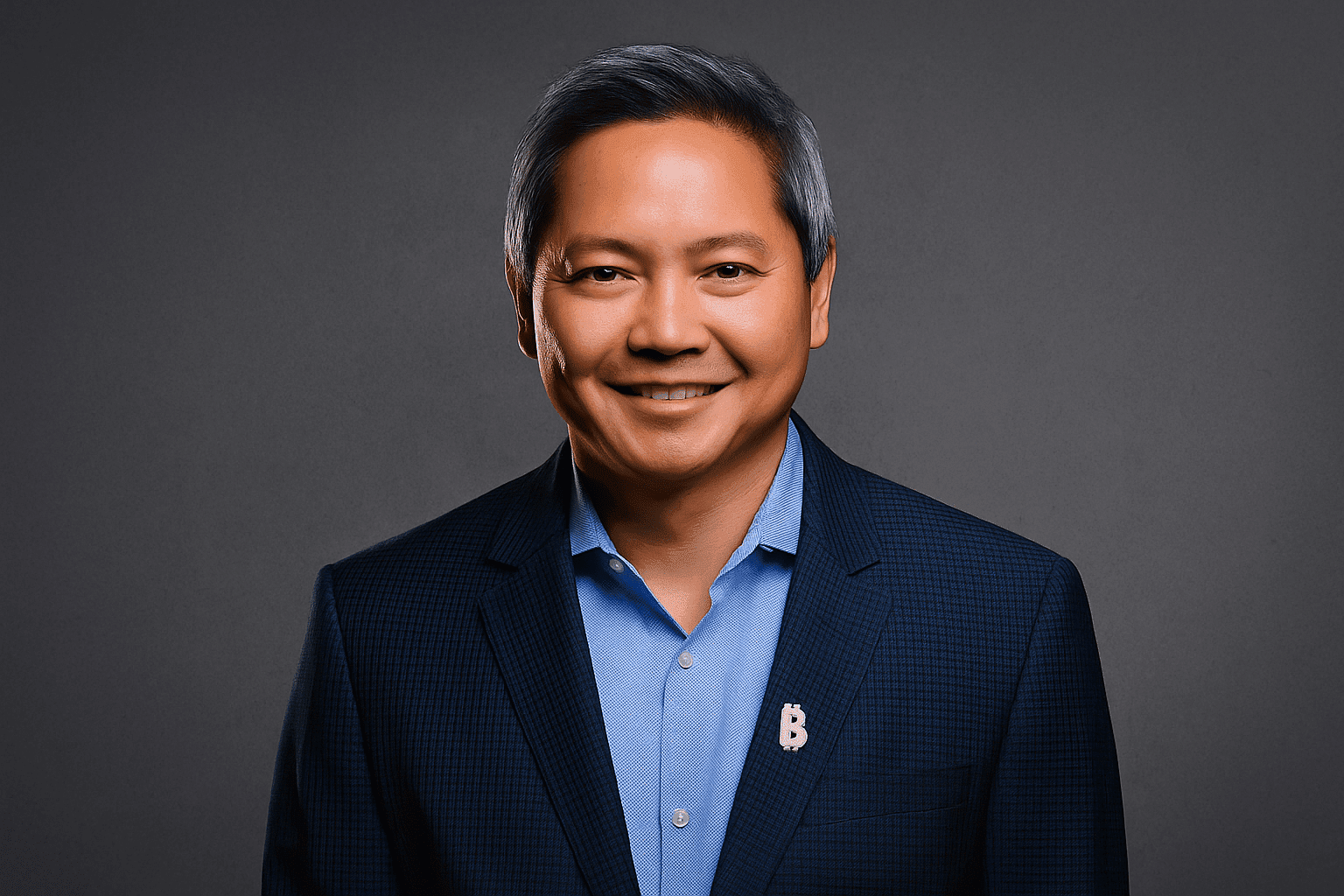

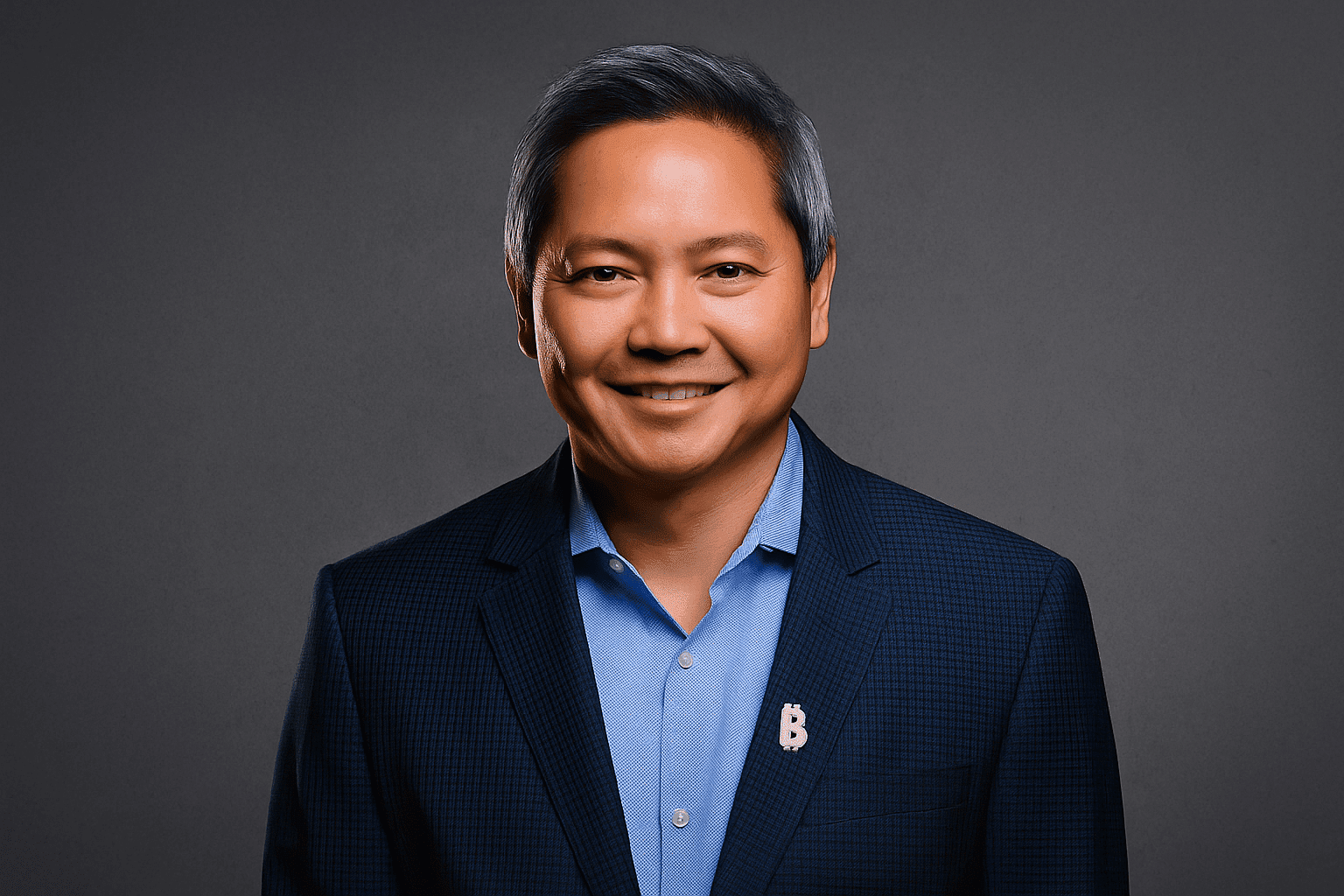

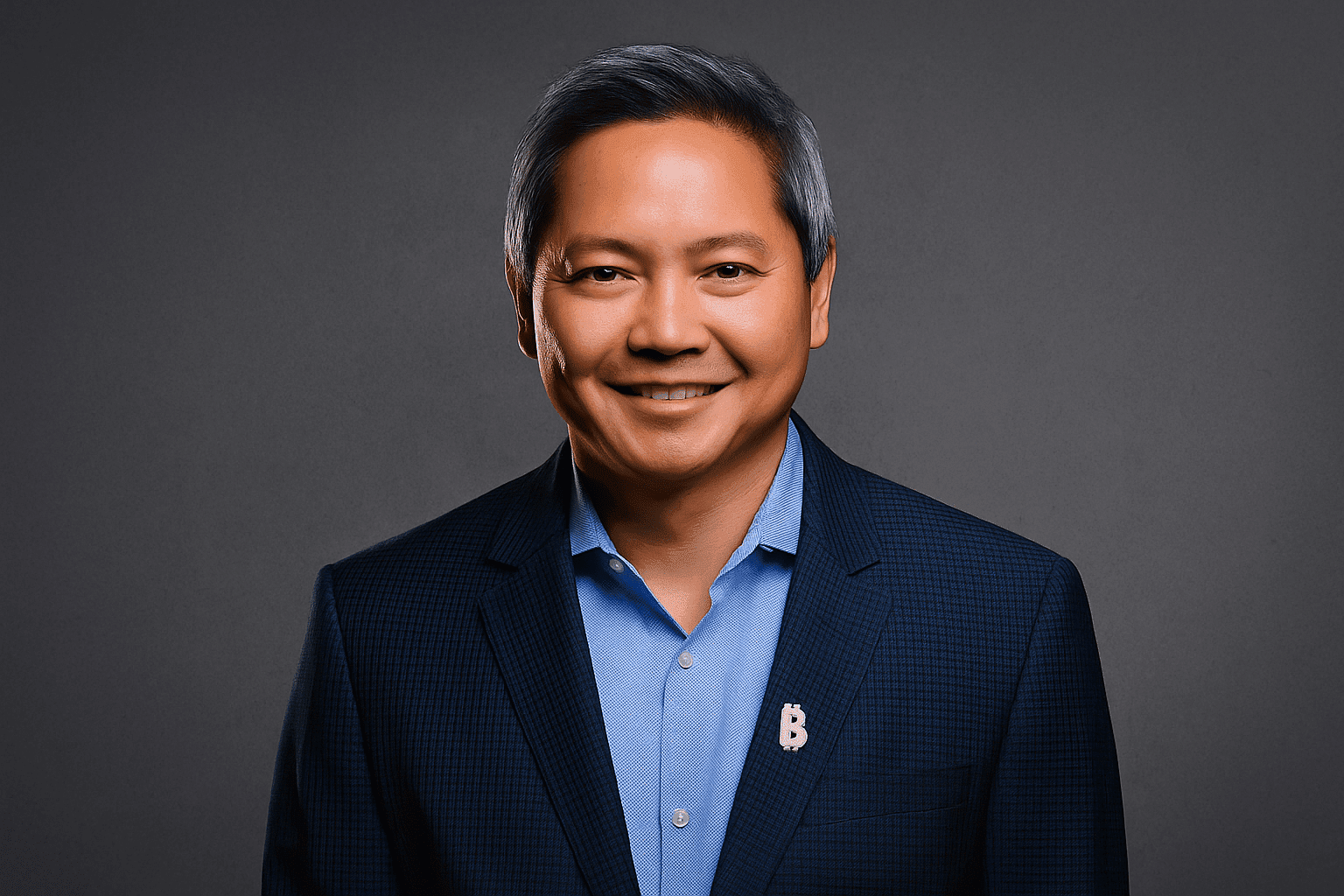

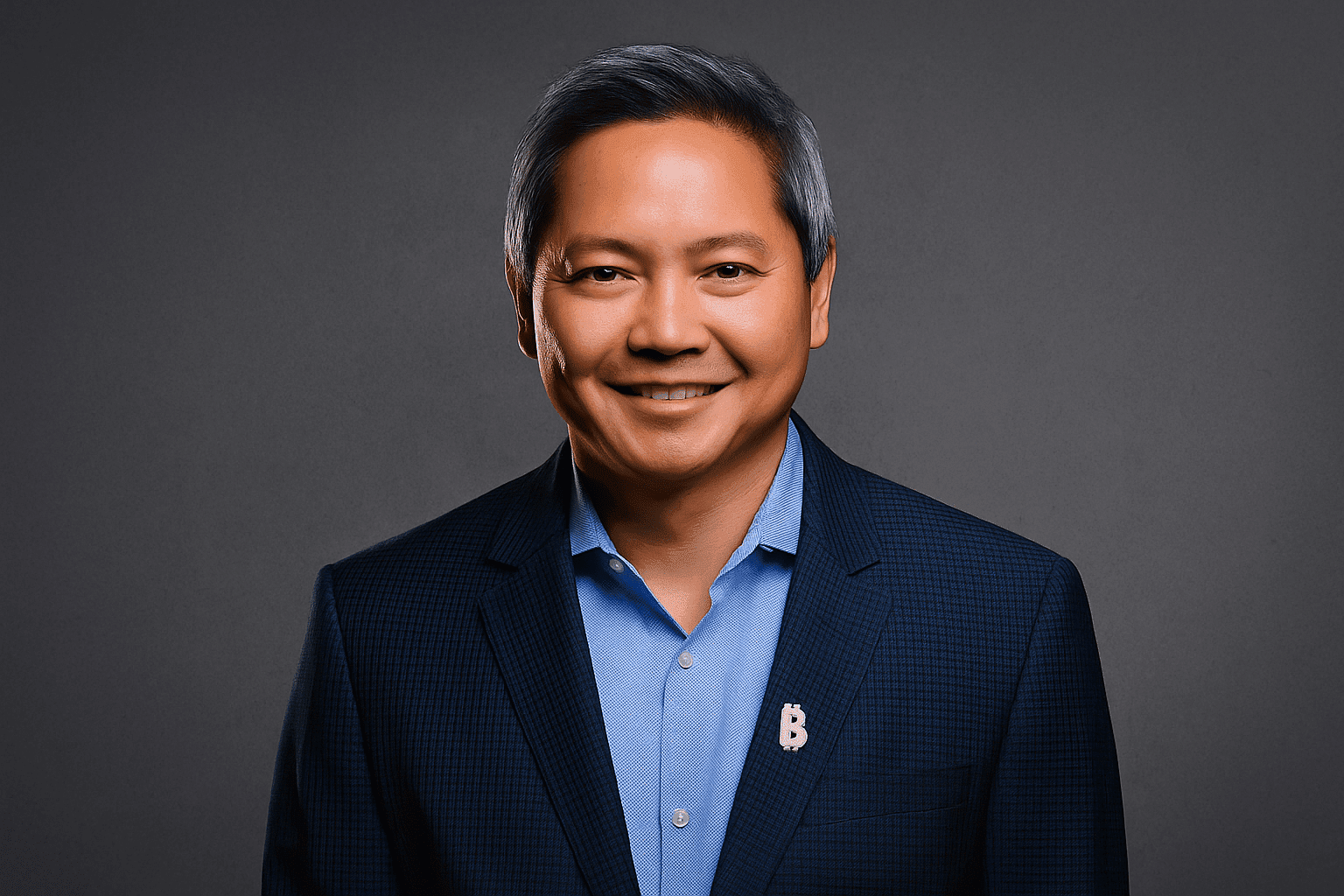

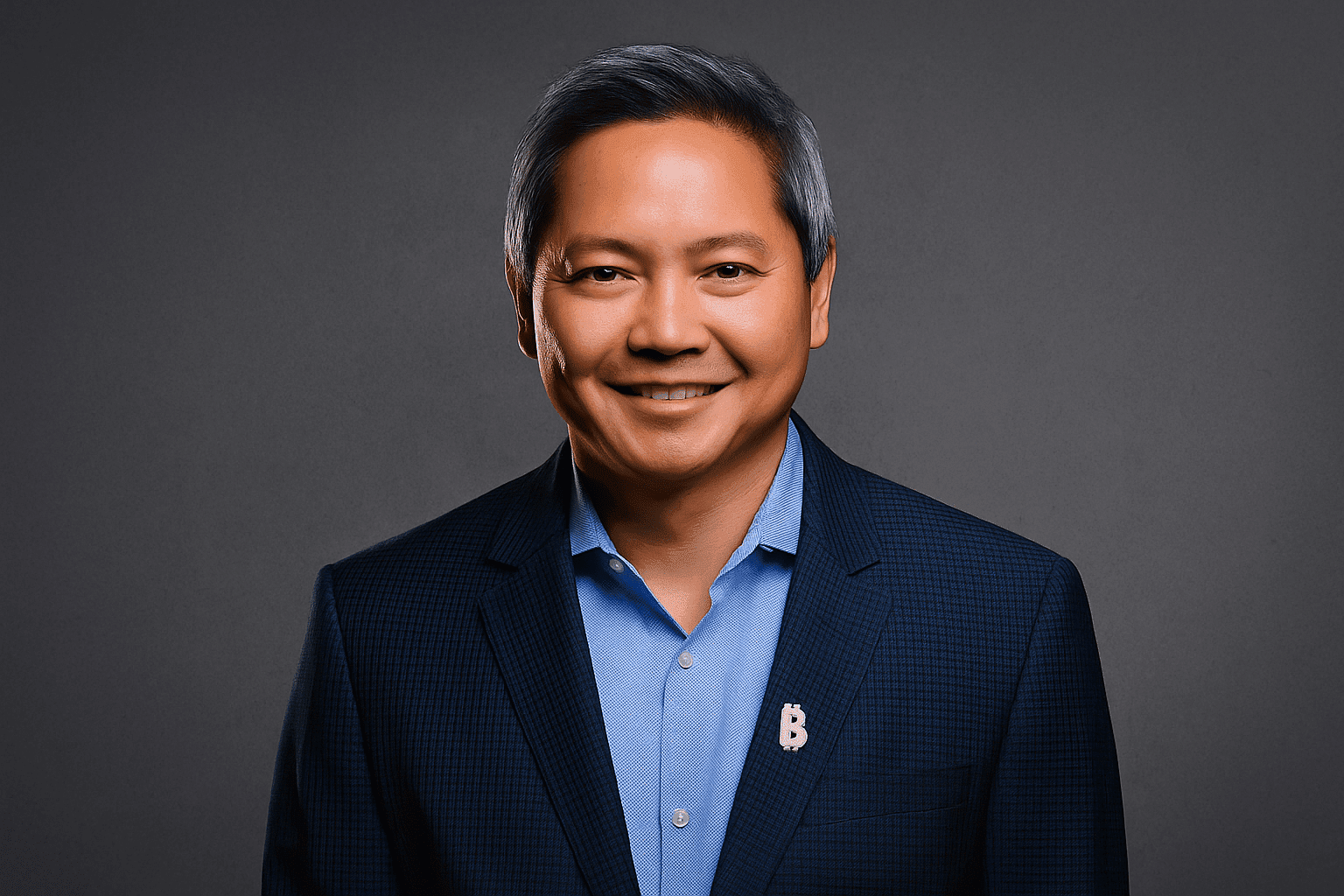

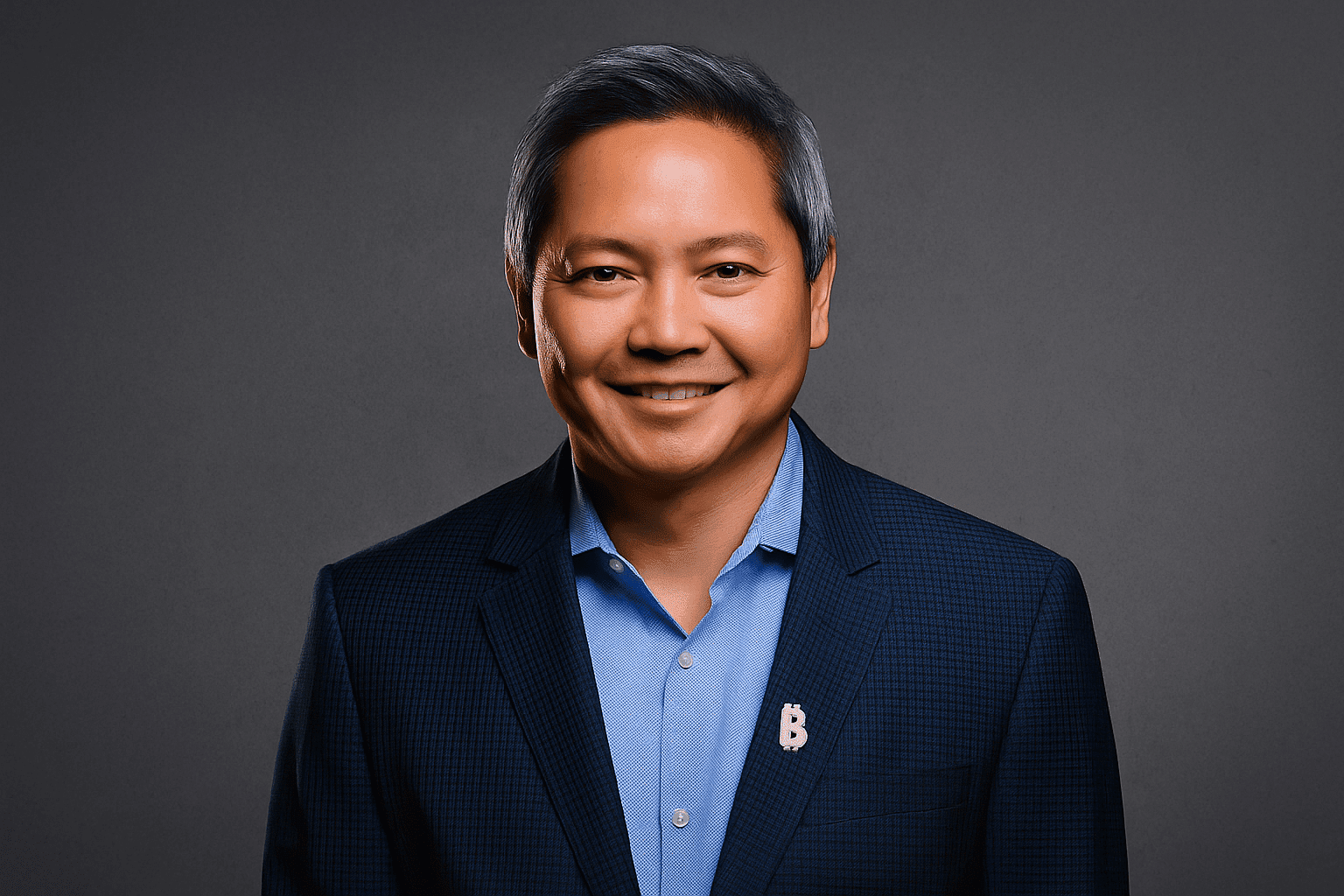

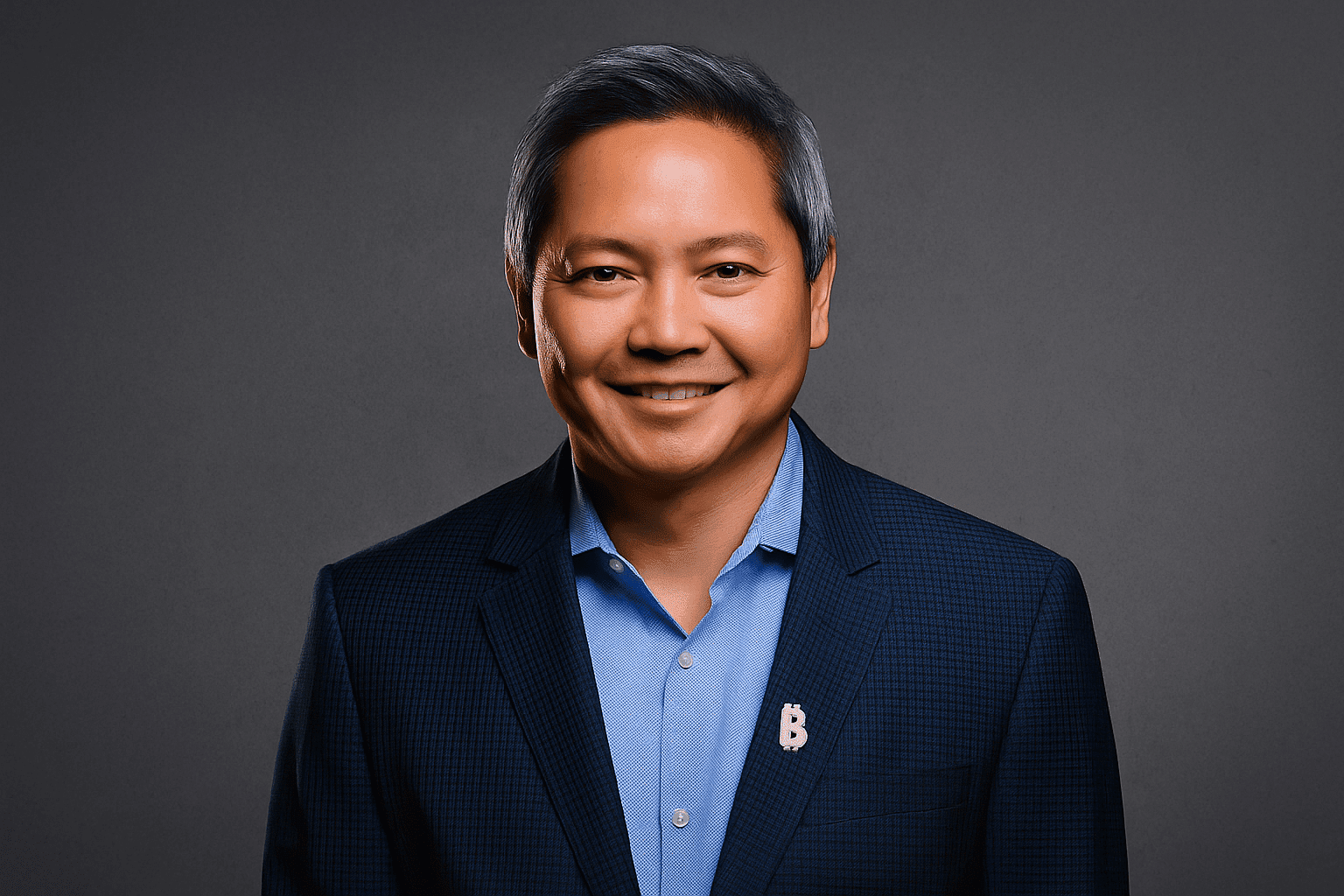

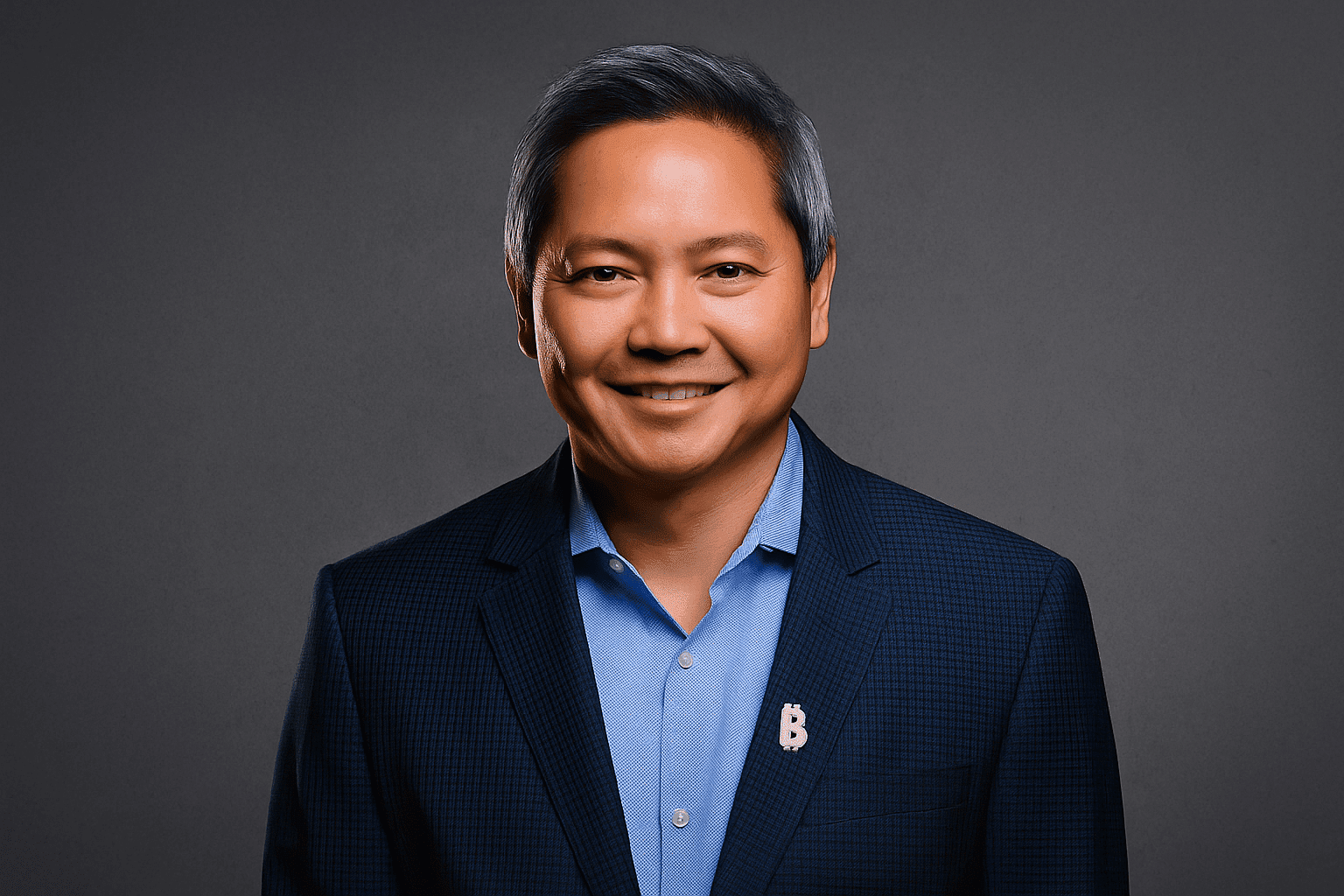

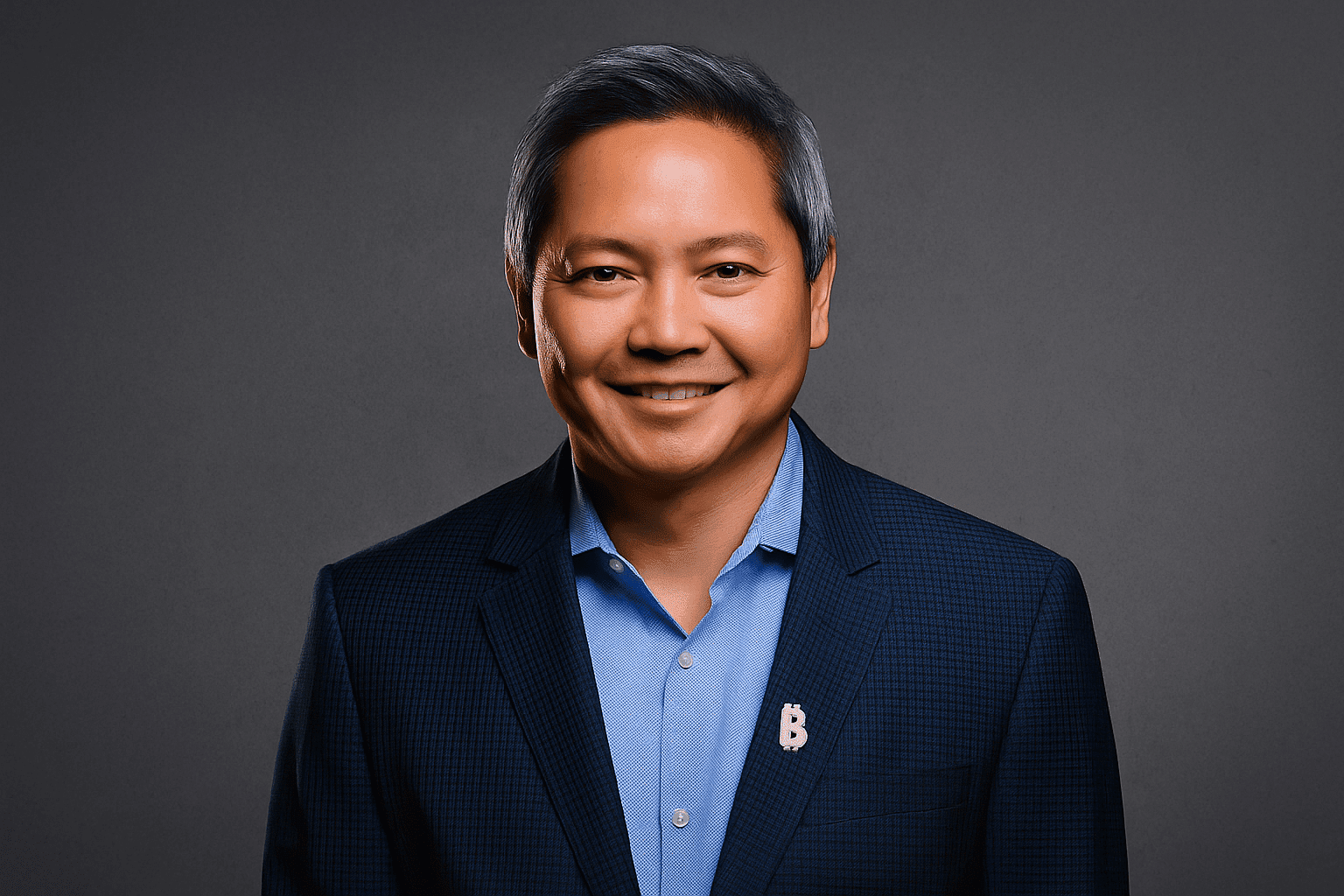

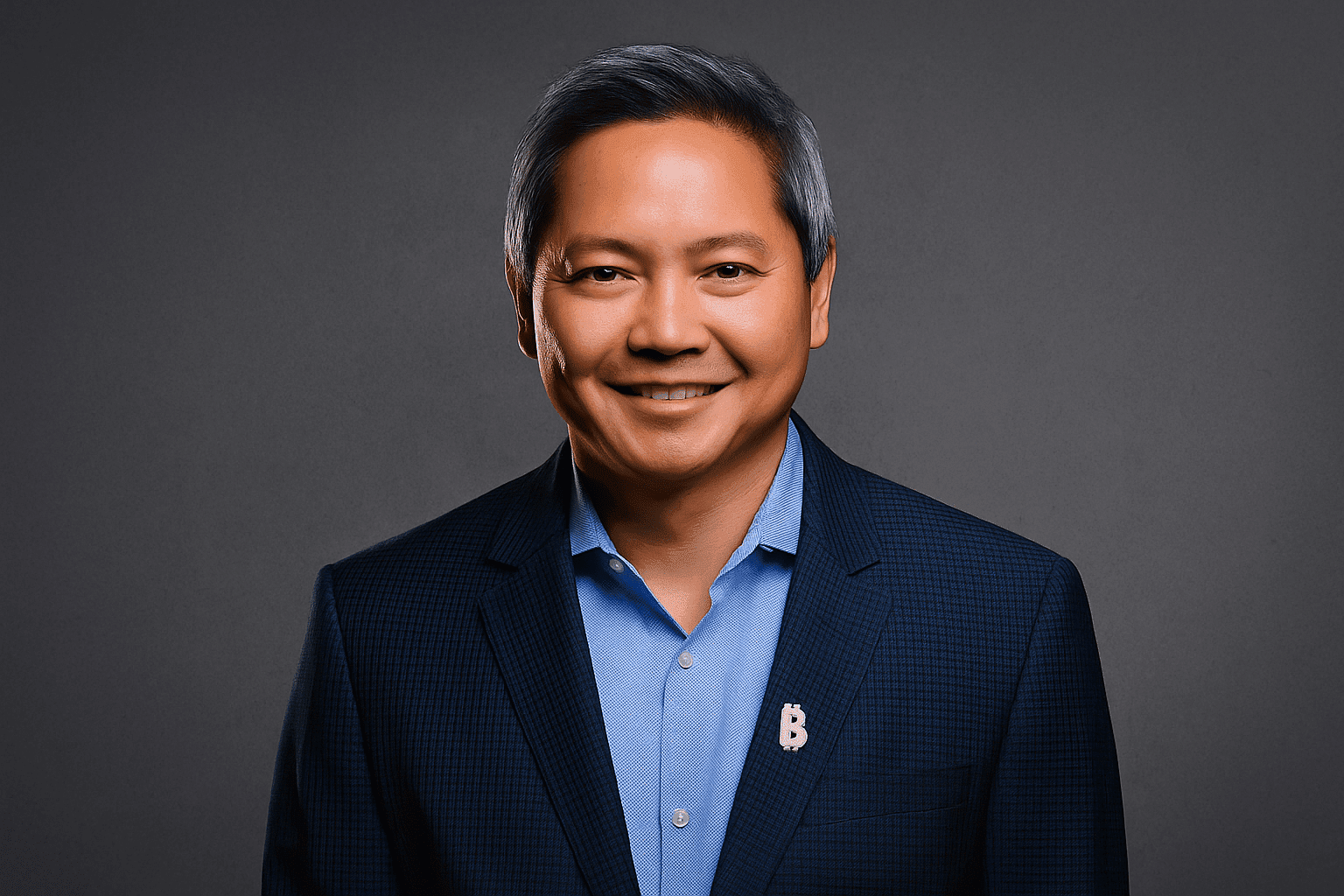

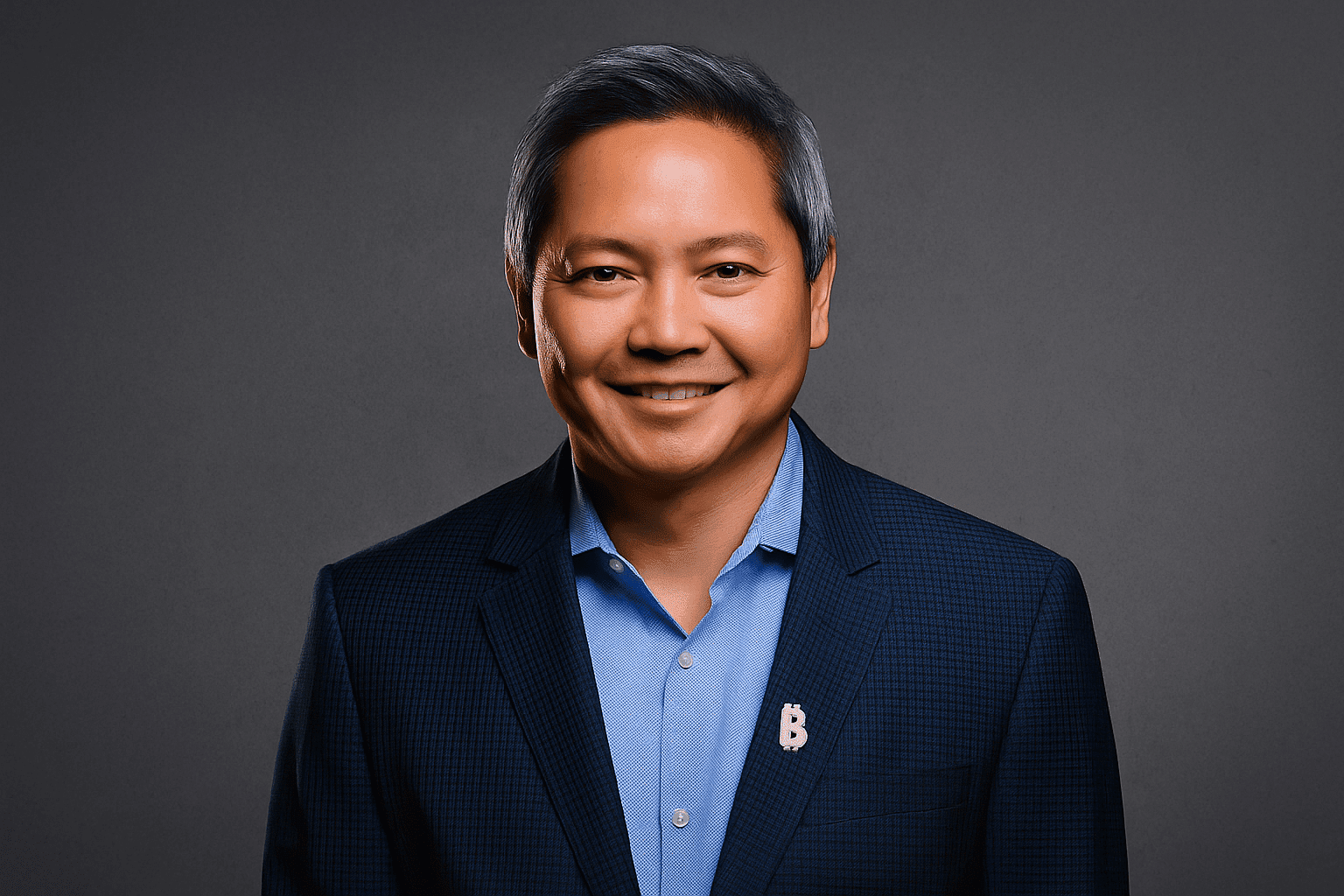

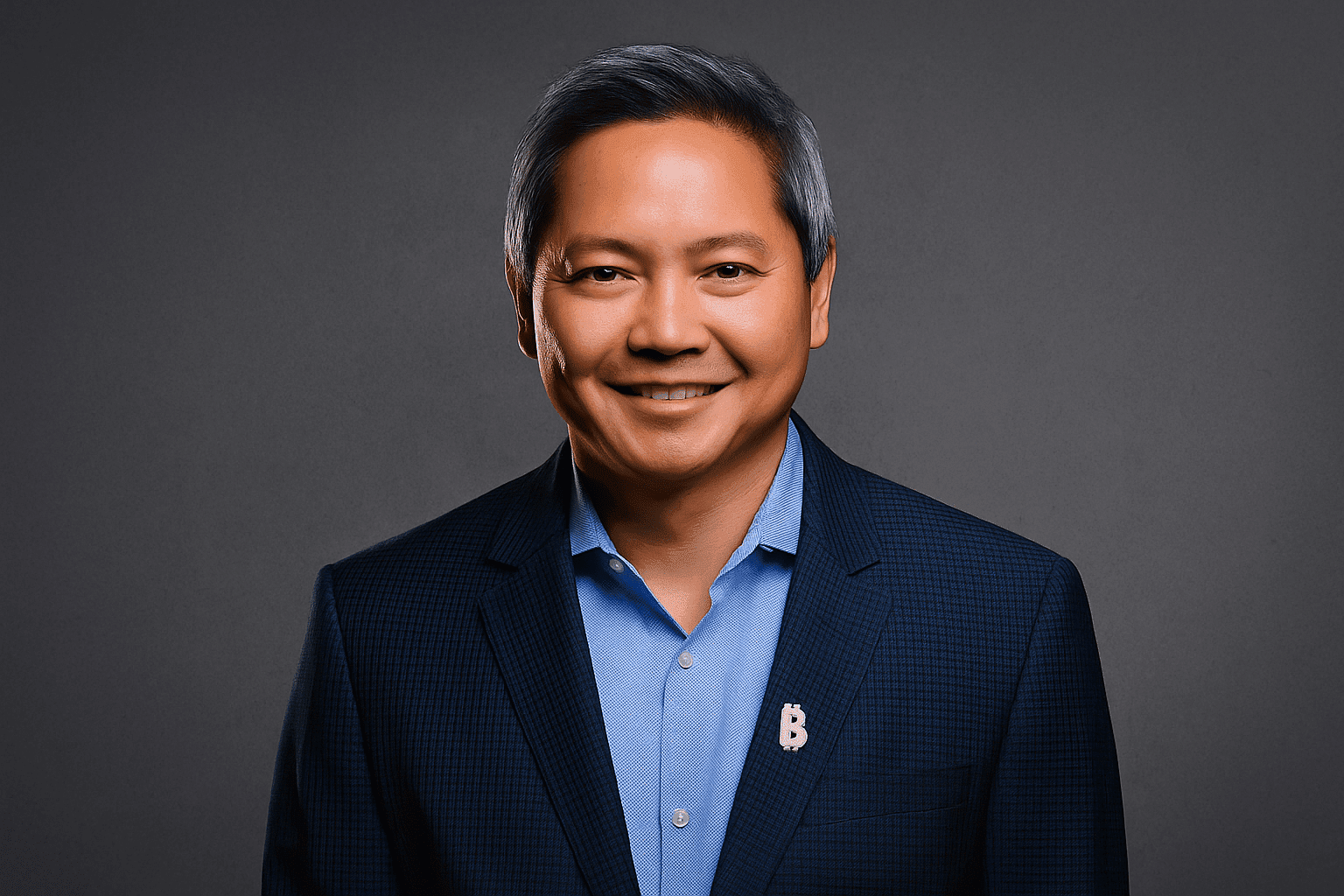

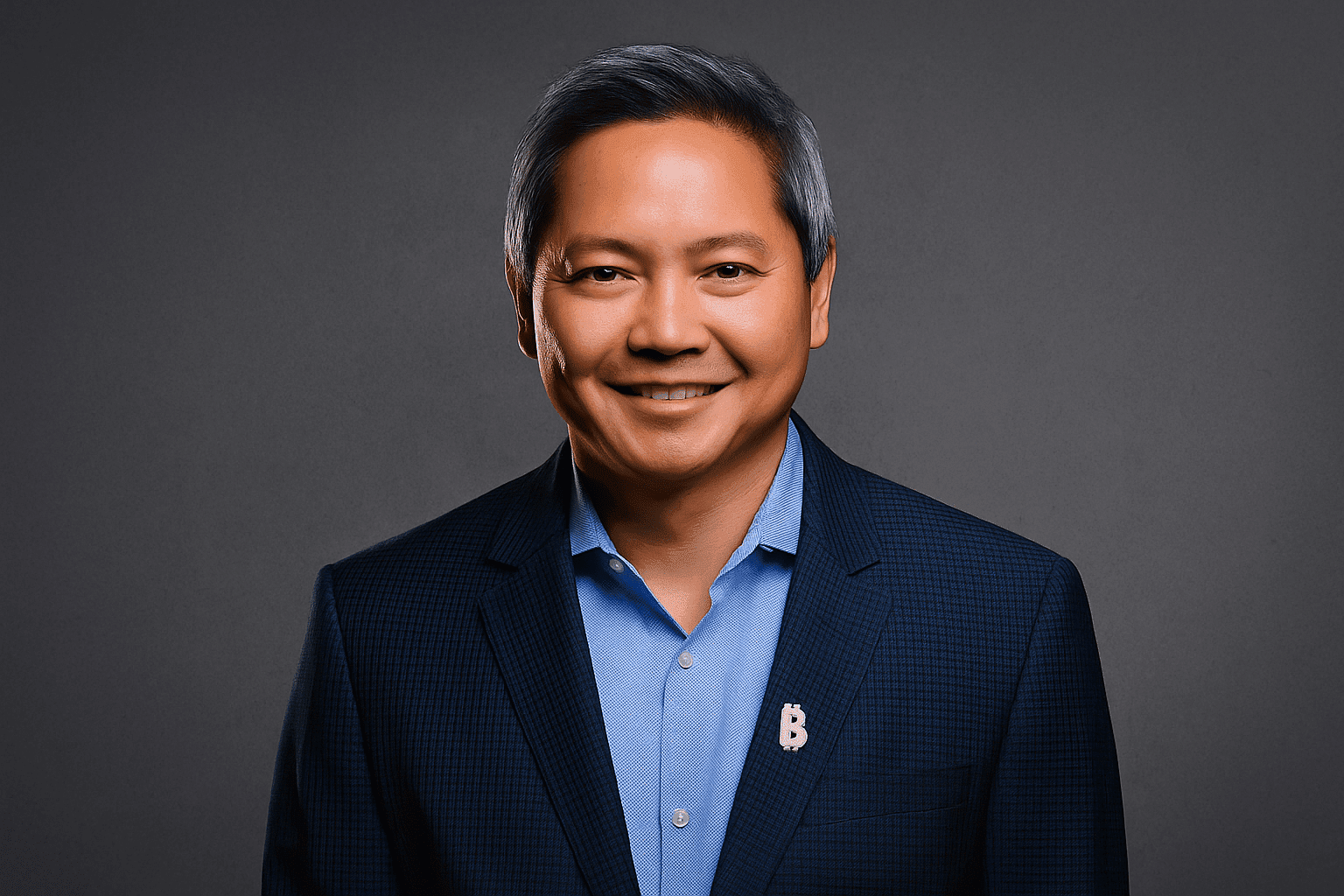

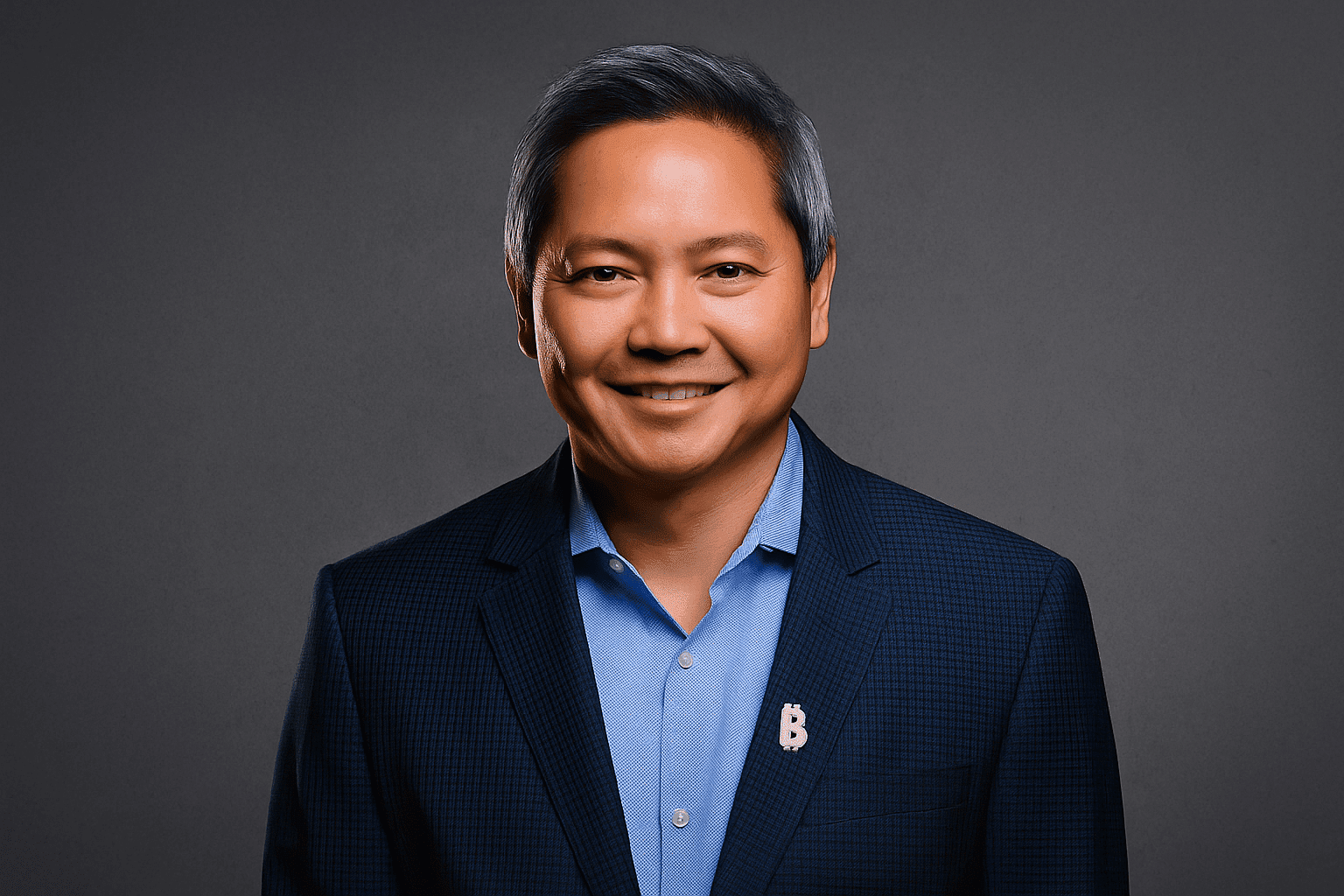

Phong LeePresident & CEO

Phong Lee leads Strategy’s twin engines: a Bitcoin-backed capital stack and a mature enterprise analytics business. His playbook is simple: build for the customer first, ship with conviction, and let time do the compounding.

Founder Stats

- Technology, SaaS, AI, Finance, Cryptocurrency

- Started 2020

- $1M+/mo

- 50+ team

- USA

About Phong Lee

From the first Bitcoin buy in 2020 to a family of Bitcoin-backed preferreds in 2025, Phong Lee has steered Strategy through a rare blend of product focus and capital markets innovation. In this conversation he shares lessons on product-market fit, patient scaling, why preferreds broaden the investor base, how software and Bitcoin support each other, and why milestones like bank custody matter more than price targets. He also digs into the BI roadmap, a universal semantic layer for AI agents, and the culture practices that keep a global team shipping.

Interview

November 05, 2025

Why do Strategy’s preferreds appeal to both young and older investors?

Different people want different return and risk. If you strap public securities to Bitcoin they tend to perform better. Equity has higher return and volatility. Debt and hybrids have lower return and volatility. Preferreds sit in the middle, so they fit many profiles from Robinhood millennials to retirees who want income.

What problem do preferreds solve for a 20-something saver?

Before, a bank account paid almost nothing and a money market maybe ~4% before taxes. A Bitcoin-backed preferred paying around 10.25% monthly and tax deferred is a real place to save. It lowers time preference and gets people into the habit of saving.

What did Robinhood’s listing of the preferreds tell you?

There is real demand. Robinhood had to build support for a dividend-paying instrument and moved fast. Now they have a platform for preferreds in general. That helps us and can transform the market over time.

How big can preferreds get and what timeline do you imagine?

Money markets and savings are about $30 trillion. One percent is $300 billion. Could we reach $30 billion? I think we could. Timing is hard. These instruments need to season. Our first preferred launched eight months ago and Stretch launched three months ago. Give it time to mature.

Do preferreds compete with the common stock?

I see an ecosystem, not a fight. Common is the alpha. Preferreds, converts, and notes support the common. Different products for different needs like owning a phone, watch, and earbuds. Together they strengthen the stack.

How did issuing Stretch affect the capital stack?

We issued about $2.5 billion of Stretch with zero upfront dilution and bought Bitcoin. That is accretive to BTC yield, supports the equity, and helps the rest of the stack. It also increases demand for Bitcoin.

What management lesson did you learn from the 2020 Bitcoin pivot?

Adoption takes longer than you expect. I thought the floodgates would open in 2021. It took founder-led tech CEOs to move first and several years to hit a tipping point. Big vision plus patience matters.

Did you expect the cultural wave merch, sneakers, orange phones?

Not at that scale. We hoped Bitcoin would open doors. The passionate community surprised us. The merch store is just giving back. People across the company pitch in because they love Bitcoin. Passion creates chances you did not plan.

How do the software business and Bitcoin business help each other?

They are complementary. Bitcoin lets us focus long term on product, not just quarterly numbers. The mature software business funds capabilities like media and a studio that also support Bitcoin education and the community.

What is Strategy’s BI track record in simple terms?

We helped invent modern BI. First enterprise analytics on the web in 1998, first mobile analytics in 2008, early cloud analytics in 2012. The software business has about 1,500 people, high retention, and serves nearly half the S&P 500.

Where does BI go next with AI in the loop?

AI needs business-level definitions of data at scale. We are building a universal semantic layer so agents can access secure, governed, business-language data. We call it a mosaic. That is the unlock.

What operating principle keeps a global team shipping fast?

Write things down. Put people in every time zone. Work keeps moving as one team signs off and another signs on. Async and written culture keep speed without constant calls.

How do you win trust with larger customers?

Security, stability, and performance. We don’t brag about them, we just do the work every week. Over years, that builds confidence and wins bigger accounts.

How do you think about growth in 2030 without quoting dollars?

If we are moderately successful, the Bitcoin business and the software business are each an order of magnitude bigger. People may still ask if we care about software. The answer is yes. Both markets are huge and support each other.

What marks the next wave of Bitcoin adoption?

Traditional banks offering Bitcoin custody, yield, and loans. When you can hold Bitcoin at your main bank and borrow against it, that is a major unlock. I think a large bank will offer custody by the end of 2026.

Price targets or milestones what should people focus on?

Milestones. ETFs were a milestone. Bank custody is a milestone. Access and utility drive adoption. Price follows that.

What message do you leave for investors worried about volatility?

Understand the asset and the company. We have a 35-year innovation history, a visionary founder, a strong team, and a clear record of execution. Do the work, think long term, and let compounding do its job.

Table Of Questions

Video Interviews with Phong Lee

The Next Trillion Dollar Company | Phong Le Interview

Cite This Interview

Use this interview in your research, article, or academic work

Related Interviews

Mark Shapiro

President and CEO at Toronto Blue Jays

How I'm building a sustainable winning culture in Major League Baseball through people-first leadership and data-driven decision making.

Harry Halpin

CEO and Co-founder at Nym Technologies

How I'm building privacy technology that protects users from surveillance while making it accessible to everyone, not just tech experts.

Morgan DeBaun

Founder at Blavity

How I built a digital media powerhouse focused on Black culture and created a platform that amplifies diverse voices.