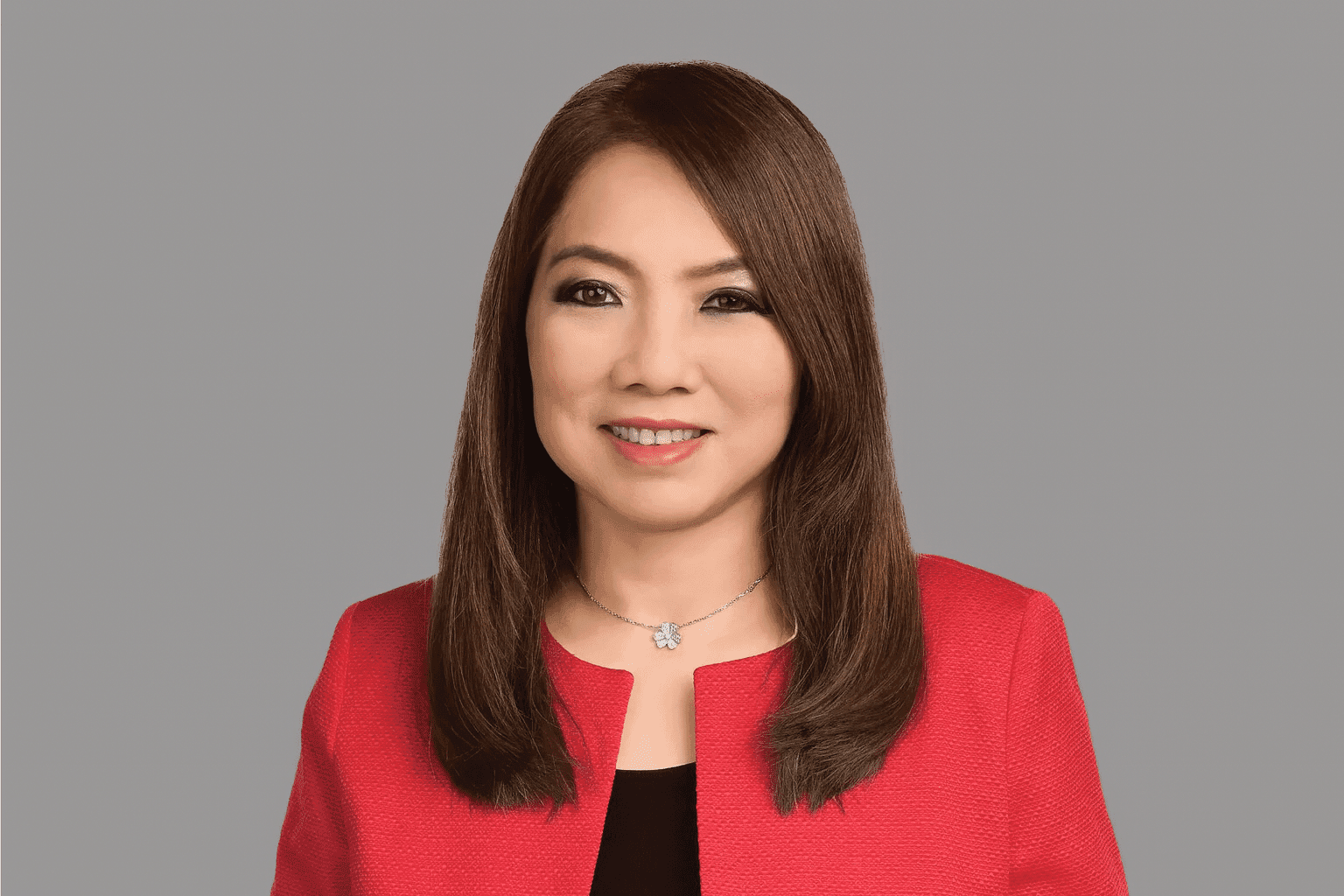

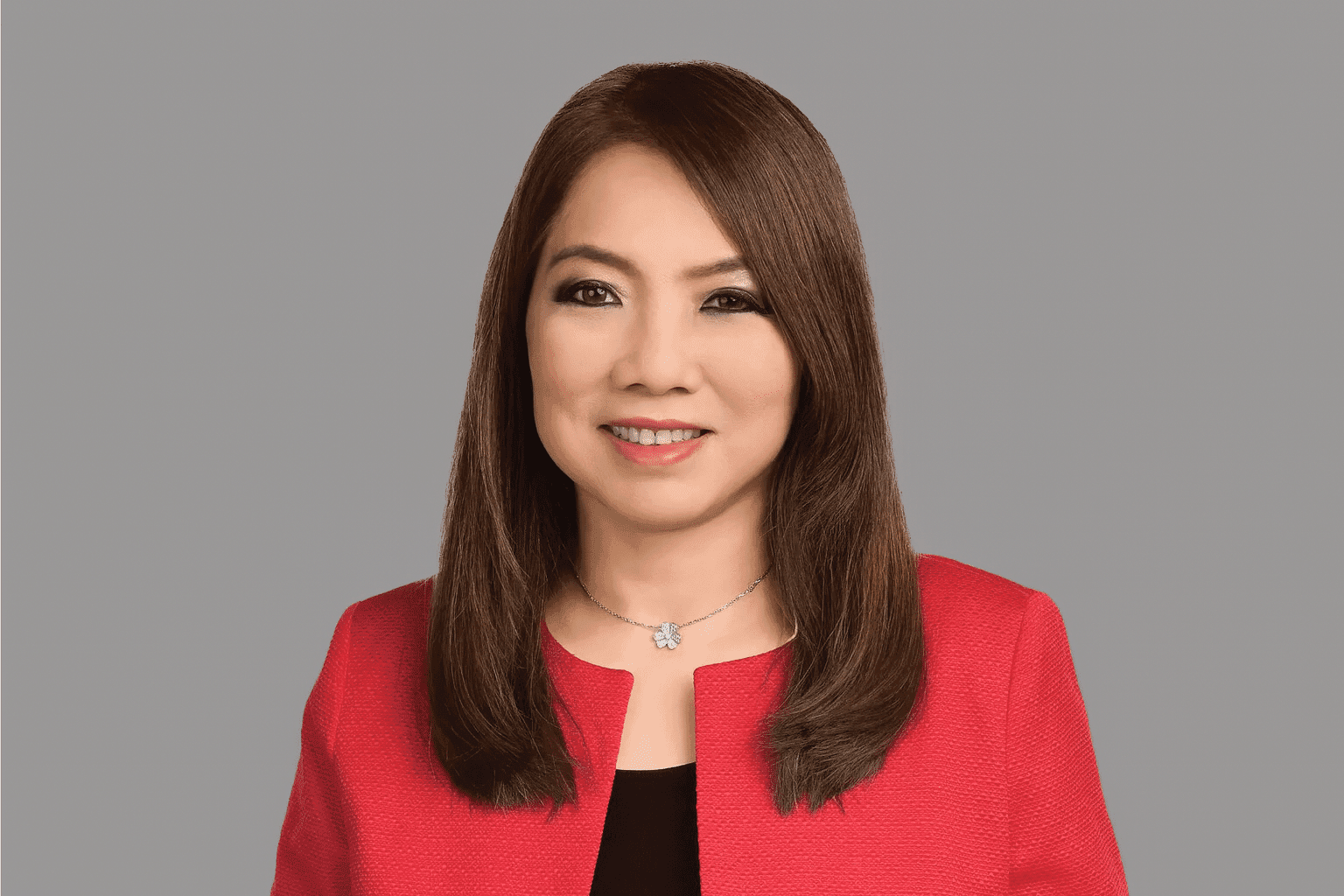

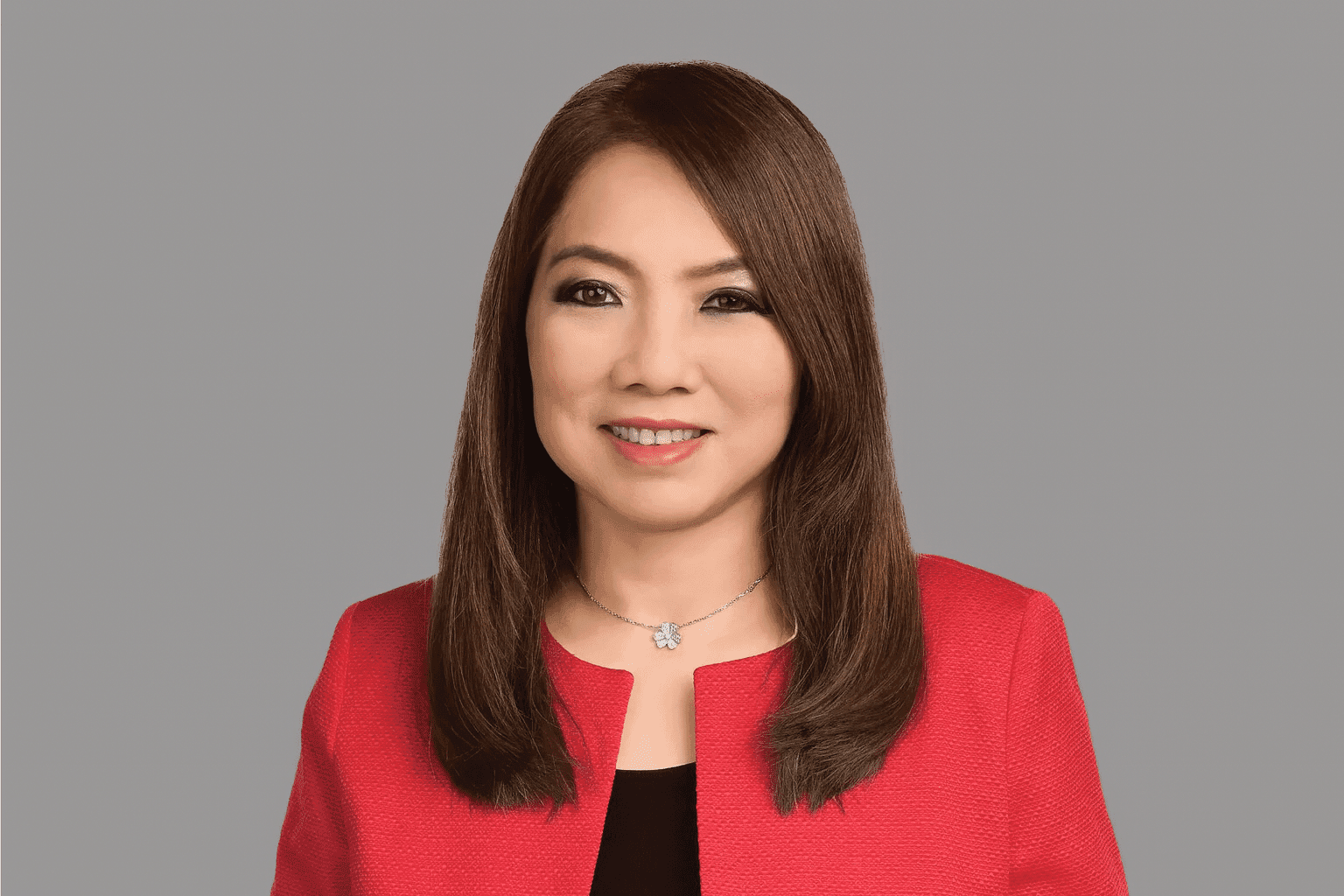

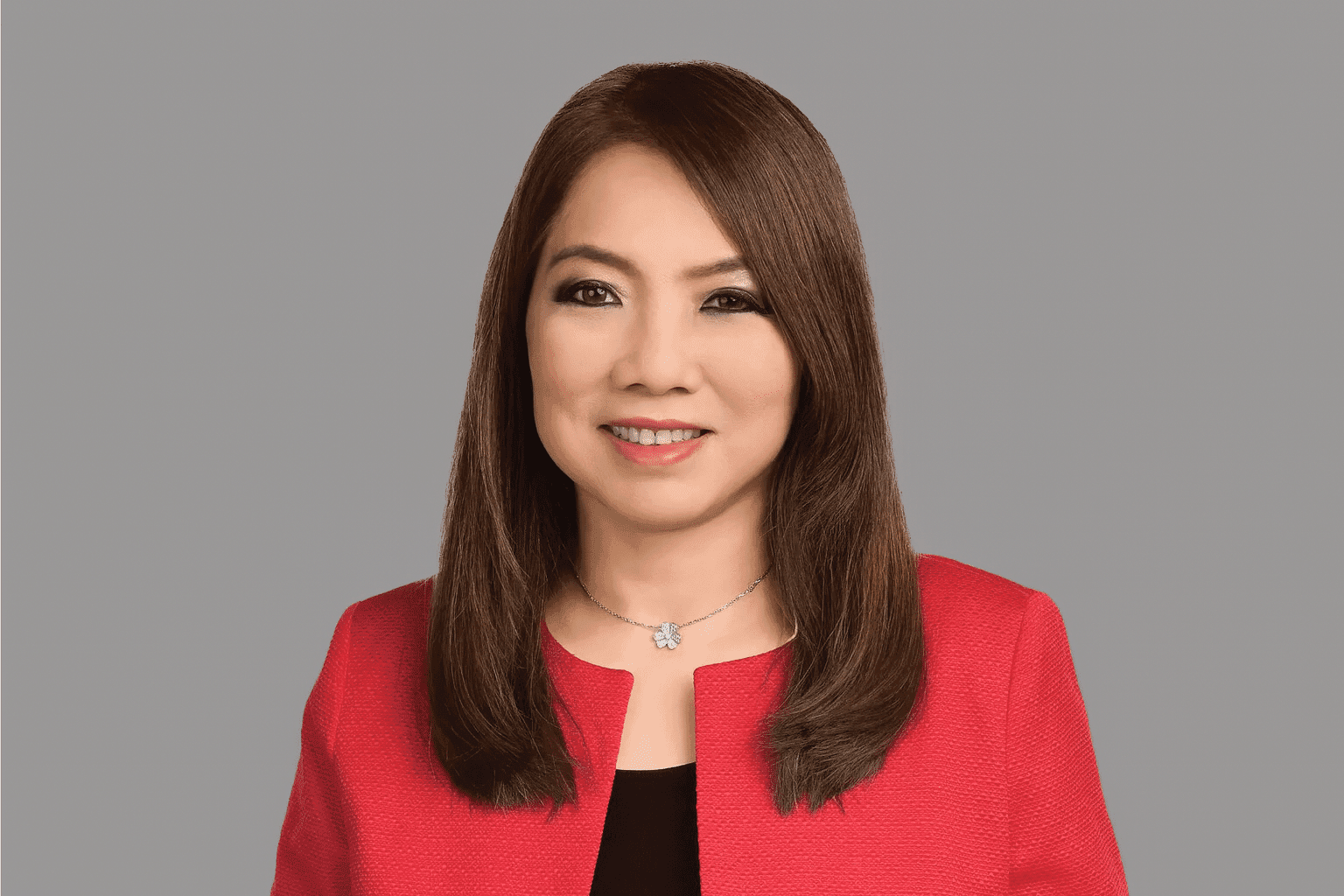

Tan Su ShanGroup CEO & Director

Tan Su Shan is leading DBS through a volatile macro cycle, pushing diversification, AI-enabled banking, and digital assets while trying to keep the bank dependable and human at the same time.

Founder Stats

- Banking, AI, Finance

- Started 2015 or earlier

- $1M+/mo

- 50+ team

- Singapore

About Tan Su Shan

Tan Su Shan took DBS's top job in a storm and doubled down on diversification across Asia and the GCC. She is building a digital and data moat so the bank can absorb classic, generative, and agentic AI while staying an "AI-enabled bank with a heart." DBS is testing tokenized assets with strict custody, banking high-growth tech through a digital economy group, and reskilling people for new roles, all to avoid single points of failure and stay close to customers.

Interview

November 26, 2025

You described your first days as CEO as a “baptism of fire”. What did you learn from taking over in such a turbulent time?

COVID was a dry run. It taught us to stress test unknown unknowns and avoid single points of failure. Diversify energy, taxes, supply and demand chains, vendors, clients, currencies. When markets froze on April 2, we just hit that diversification button harder.

You often talk about diversification. How has that mindset changed how businesses operate?

Shocks moved diversification from nice-to-have to must-have. Clients now talk China plus N, not plus one, diversifying demand, supply, and funding. No country, currency, or technology is permanently safe; anything can be weaponized. You have to stay agile and act with imperfect information.

How do you see new trade corridors developing, especially outside the US?

Trade outside the U.S. is already about 89 percent. We see more flows between Asia and the GCC, intra-Asia, Asia to the EU and UK, Eastern and Western Europe, Taiwan to India, China to the GCC. New corridors and relationships are forming at a scale we have not seen before.

What is your view on intra Asia trade and its ability to offset a US slowdown?

Intra-Asia trade looks promising: Singapore–Malaysia, China–Malaysia, China–Vietnam, Japan and Korea into Southeast Asia, lots of north–south flows. I am hopeful India and the rest of Asia will grow too. It will not replace a U.S. slowdown overnight, but regional links can balance shocks.

China has been going through property and growth challenges. Where do you see real opportunity there?

Property is uneven: tier one cities like Shanghai show pockets of recovery; many smaller cities still struggle. Opportunity is in tech deep tech, AI, biotech, small language models, humanoid robots, low-flying drones areas the government supports. Consumer confidence is soft, but new economy sectors are dynamic.

How is DBS positioning itself onshore in China for the future?

We follow China's stated science and tech priorities and focus on those deep tech sectors. Onshore wealth management is a big opportunity because rates are low and money is leaving property. We opened a wealth centre in Shanghai and may add more, while backing new economy companies and helping them expand globally.

You mentioned a digital economy group at DBS. What is different about how you bank high growth tech companies?

Traditional banking lenses often avoid high-growth tech. We built a digital economy group to think differently: raise money, structure capital stacks, bring in VCs, do convertibles, support A/B/C rounds toward IPO. We also set up a growth debt fund with partners to bank them in a tailored way.

You invested in Shenzhen Rural Commercial Bank. What makes that partnership valuable?

It is complementary. They are onshore; we are more offshore. We do not bank their clients and they do not bank ours. They help us with local SMEs we may not understand; we help their larger clients go global. With limited property exposure and conservative posture, it is a clean, steady bank, and we help build their onshore wealth platform.

You said DBS has built a “digital moat” and a “data moat”. What does that mean in practice?

Digital moat means modernising the tech stack and escaping monoliths we are in the last 10%. Data moat means putting legacy data into a governed lake with metadata so we can build models. Since 2016 we have focused on end-to-end data governance: how data is born, secured, used, and purged.

How is AI changing your organisation and your people’s jobs?

We moved from classic to generative and agentic AI. It changes everything: AI can read 'one eye, ten thousand lines.' Process and analytics tasks shift to machines, so some jobs change. Our data scientists now focus more on customer interaction and ideation, designing use cases and testing with the models.

Are you worried that AI will cause big job losses in banking?

Every big tech shift brings a bubble, fear of job losses, then correction. Roles will change, especially entry-level white collar; you may not need 100 analysts. Governments and business must work together. During COVID we still hired graduates with support so they gained experience even if they later joined competitors.

You said “hire for attitude, not for knowledge”. Why is that so important now?

Knowledge is abundant you can search, ask AI, learn online. Attitude is rare. We need curious people willing to change roles and try new things. If you do not make it safe to move, reskill, and experiment, the organisation gets stuck while technology and markets move ahead.

How do you personally stay current with young customers and new trends?

I use reverse mentors younger colleagues who tell me when I am behind. Watching teenagers shows the future. After seeing games in Korea, we partnered with Garena in Taiwan, offering card rewards redeemable for in-game weapons and gained tens of thousands of users on day one. I learn by observing and asking.

How much time do you spend actually learning about AI and new tech yourself?

I learn by doing and by talking to people deep in the work. I do not code models, but I sit with teams, ask questions, and see real use cases. I also listen to young talent about social, gaming, and AI tools. Curiosity is mandatory to lead a bank in this environment.

You were an early mover in digital assets and tokenization. Why did you step into that space as a bank?

As a trusted intermediary we hold deposits, lend, and help clients invest. When assets move on-chain, we still need to play that role. People forget keys and get scammed. We built strong custody cold, hot, air-gapped and then a digital exchange so clients could on- and off-ramp and transact safely.

You recently launched tokenized products with asset managers. What is the philosophy behind that?

If clients hold cash on-chain, they deserve yield; it should not all go to stablecoin issuers. We tokenized funds with partners and listed them on our exchange so clients can stay in the digital asset ecosystem while earning regulated yield.

You clearly care about financial literacy and democratizing wealth. What is your vision there?

Wealth management should not be only for private banking. Whatever we build for the top, we try to bring to the mass market digitally: simple portfolios by risk level and regular 'save, invest, repeat' plans. We also do community education so people understand credit, CPF, and investing and avoid getting hurt.

Table Of Questions

Video Interviews with Tan Su Shan

LIVE: Tan Su Shan: DBS CEO Reveals AI Strategy and Future Growth Vision | Reuters NEXT | AI1Z

Cite This Interview

Use this interview in your research, article, or academic work

Related Interviews

Mark Shapiro

President and CEO at Toronto Blue Jays

How I'm building a sustainable winning culture in Major League Baseball through people-first leadership and data-driven decision making.

Harry Halpin

CEO and Co-founder at Nym Technologies

How I'm building privacy technology that protects users from surveillance while making it accessible to everyone, not just tech experts.

Morgan DeBaun

Founder at Blavity

How I built a digital media powerhouse focused on Black culture and created a platform that amplifies diverse voices.